When Cashflow Becomes the Real Emergency

When cash starts tightening, everything else becomes noise.

Sales can look fine. Orders may still come in. But if money is not coming back into the bank on time, the business starts suffocating. Payroll becomes stressful. Vendors push. Inventory piles up. Owners lose sleep.

This is the stage where most businesses make the wrong moves. They cut marketing. Delay hiring. Postpone investments. But they do not fix the real problems.

The real problems are usually:

- Invoices not going out on time

- Customers paying late without follow up

- Inventory blocking cash

- Uncontrolled purchasing

- No clear view of receivables and payables

- No short term cash forecast

At this point, long term transformation is irrelevant. The priority is survival.

You need:

- Faster collections

- Tighter control

- Clear visibility

- Immediate discipline

This is not the time for big ERP projects. It is the time for sharp execution.

Odoo works in turnaround situations because it gives control fast through structured Odoo implementation focused on operational visibility, not in months but in weeks.

When set up correctly, Odoo becomes the control room for cash. It shows where money is stuck, who owes you, what is overstocked, and where spend is leaking.

That is what matters in a cash crisis.

Why Odoo Is Effective for Short Term Cash Stabilization

Most tools are built for growth. Not for recovery. Odoo is different because it connects the exact areas that affect cash.

- Sales.

- Invoicing.

- Receivables.

- Inventory.

- Purchasing.

- Expenses.

All in one system.

This is critical because cash problems are never in one place. They are spread across departments.

Odoo helps because:

It exposes reality quickly

Within days of use, you can see:

- Which customers are overdue after consolidating fragmented financial and operational data

- Which invoices are pending

- Which products are not moving

- Where stock is piling up

- Which vendors are being overpaid

- Which expenses are uncontrolled

No reports to build. No data to compile. It is visible.

It removes manual delays

Manual processes slow everything.

With Odoo:

- Invoices are generated immediately

- Reminders can be automated

- Stock updates in real time

- Purchase approvals are controlled

Speed improves without adding people.

It enforces discipline

Cash recovery fails when rules are not enforced.

Odoo enforces:

- Approval flows

- Credit limits

- Purchase controls

- Budget checks

This stops emotional decisions and brings structure back.

It works across teams

Finance alone cannot fix cashflow, which is why integrating sales, inventory, and finance workflows inside Odoo becomes critical during recovery.

Odoo gives everyone the same data. No excuses. No hiding.

That is why it works in turnaround situations.

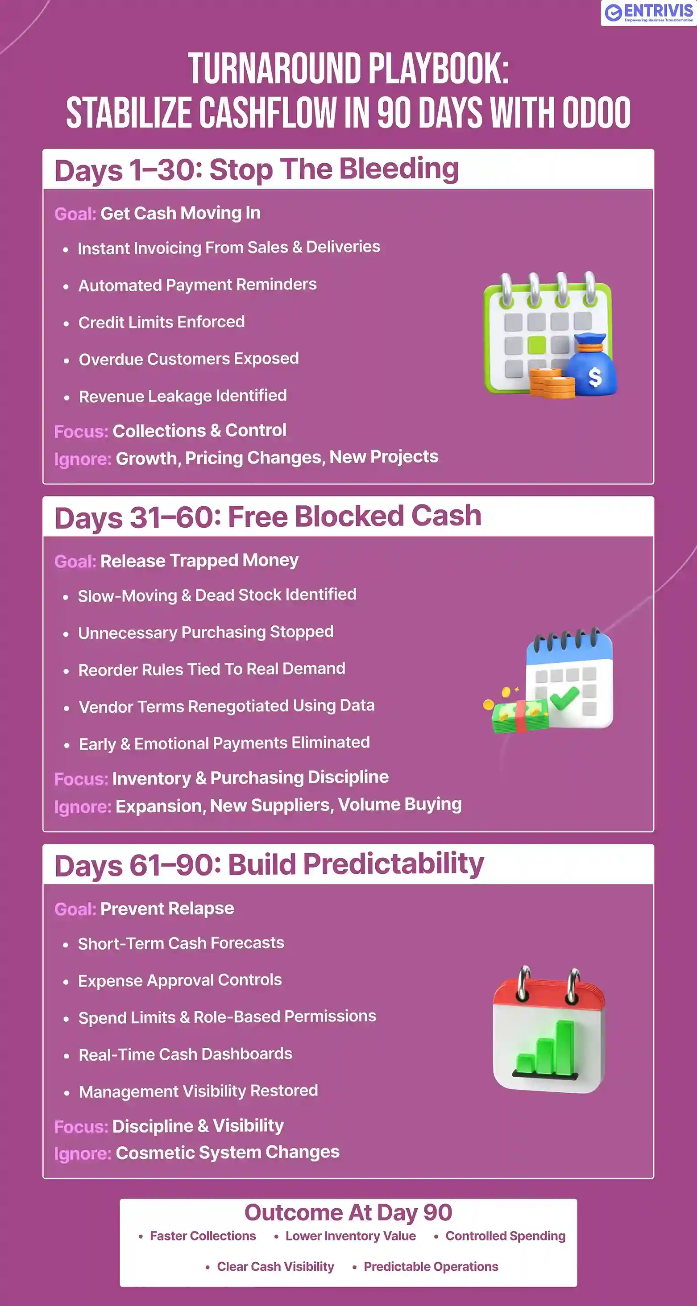

The 90 Day Cashflow Recovery Framework

Turnarounds fail when everything is treated as urgent. You end up fixing nothing properly.

The only way to stabilize cash is to sequence actions. Do the highest impact moves first. Ignore everything else.

Here is the structure that works.

Days 1 to 30: Stop the bleeding

This phase is about collecting faster and plugging leaks. Not optimization. Not improvement. Survival.

The focus is:

- Invoicing discipline

- Receivables control

- Revenue leakage

- Visibility

If money is not coming in, nothing else matters.

Days 31 to 60: Free blocked cash

Once collections are under control, you attack what is locking cash inside the business.

This phase is about:

- Inventory cleanup

- Purchase control

- Vendor terms

- Reducing overstock

This is where you release trapped money.

Days 61 to 90: Build control and predictability

Only after bleeding has stopped and blocked cash is freed do you focus on stability.

This phase is about:

- Cash forecasting

- Expense discipline

- Approval structures

- Management visibility

This is what prevents relapse.

Days 1 to 30: Stop the Bleeding Using Odoo

This is the most critical phase. Get this wrong and the rest does not matter.

Fix invoicing delays immediately

Late invoices kill cashflow.

In Odoo:

- Convert confirmed sales orders into invoices automatically

- Remove manual invoice creation steps

- Set default invoice rules per customer

This ensures every delivery becomes an invoice without waiting.

No excuses. No delays.

Clean up customer data

Bad data creates bad billing.

In Odoo:

- Validate customer addresses

- Fix GST or tax IDs

- Remove duplicate records

- Correct payment terms

This reduces disputes and payment delays.

Automate receivables follow-up

Chasing manually does not scale.

In Odoo:

- Set automatic payment reminders

- Schedule follow-ups based on due dates

- Escalate overdue accounts internally

This puts pressure on customers without burning your team.

Enforce credit limits

If customers are overdue, they should not get more credit.

Odoo allows:

- Credit limit rules per customer

- Blocking further sales when limits are breached

This protects you from digging a deeper hole.

Identify revenue leakage

Leakage is usually hidden.

With Odoo you can quickly spot:

- Delivered but not invoiced orders

- Invoiced but not paid customers

- Discounts given without approval

This is where cash is silently bleeding.

What should be ignored in this phase

Do not:

- Rebuild pricing models

- Launch new products

- Change vendors

- Start new projects

This phase is about collection and control only.

Nothing else.

Days 31 to 60: Free Blocked Cash Using Odoo

Once collections are moving, the next enemy is blocked cash. This is money sitting in stock, over purchasing, and inefficient vendor terms.

This phase is about releasing trapped cash back into the business.

Identify slow moving and dead stock

Inventory is the biggest cash trap in most businesses.

In Odoo you can:

- View stock aging

- Identify items with no movement

- See quantity versus sales velocity

- Flag dead stock

This shows where money is sitting idle.

Once visible, decisions become easy. Discount. Bundle. Liquidate. Stop reordering.

The goal is not perfect margins. The goal is cash release.

Stop unnecessary purchasing

Over purchasing kills cash.

With Odoo:

- Link purchase orders to actual demand

- Block purchases without approval

- Set reorder rules based on real consumption

- Eliminate emotional buying

This prevents new stock from blocking more cash.

Renegotiate vendor terms using data

Most businesses negotiate blind.

Odoo gives you:

- Purchase history by vendor

- Payment behavior

- Volume data

- Pricing trends

This allows you to:

- Ask for extended payment terms

- Consolidate vendors

- Reduce minimum order quantities

Vendors respond better to data than emotion.

Control vendor payments

In a cash recovery phase, not every bill is urgent.

In Odoo:

- Prioritize payments based on due date and importance

- Schedule payments instead of ad hoc transfers

- Avoid early payments unless there is a clear benefit

This improves short term liquidity.

Reduce waste and shrinkage

Manufacturing and retail businesses often bleed cash through wastage.

Odoo helps track:

- Production scrap

- Stock adjustments

- Returns

- Write offs

Once visible, teams become careful. Loss reduces. Cash improves.

What should be ignored in this phase

Do not:

- Expand product lines

- Increase stock variety

- Sign new suppliers

- Chase volume discounts

This phase is about freeing cash, not building capacity.

Days 61 to 90: Build Control and Predictability Using Odoo

Once bleeding has stopped and blocked cash is freed, the final phase is about stability.

This is where businesses either recover fully or relapse.

Build short term cash forecasts

Most businesses operate blind.

In Odoo you can:

- See expected receivables

- See upcoming payables

- Track recurring expenses

- Monitor cash position

This allows you to plan weekly, not monthly.

When you see problems early, you act early.

Enforce expense discipline

Uncontrolled expenses destroy recovery.

With Odoo:

- Set approval rules for expenses

- Block unapproved purchases

- Track spending by department

- Compare budget versus actual

This brings discipline back.

No approvals. No spending.

Introduce approval flows

Turnaround situations require control.

Odoo allows:

- Multi level approvals

- Role based permissions

- Spend thresholds

This ensures no one makes emotional decisions under pressure.

Build management dashboards

Founders should not chase data.

Odoo dashboards can show:

- Cash balance

- Overdue receivables

- Stock value

- Payables due

- Daily sales

This gives leadership control at a glance.

No surprises. No blind spots.

What this phase achieves

By day ninety, you should have:

- Predictable collections

- Controlled spending

- Reduced stock levels

- Clear visibility

- Strong discipline

This is stability.

Manufacturing Turnaround Scenarios

Stuck production inventory

A manufacturer has finished goods piling up. Cash is blocked.

Using Odoo:

- Identify slow moving SKUs

- Stop production for low demand items

- Push discounted sales

- Clear warehouse space

Result

Cash released. Storage cost reduced. Production aligned to demand.

Raw material overstock

Odoo shows excess raw material. Purchasing is stopped. Vendor terms are renegotiated.

Result

Cash conserved. No further blockage.

Retail Turnaround Scenarios

Overstocked stores

A retail chain has stock sitting unsold.

Odoo highlights:

- Store wise slow movers

- Product wise aging

Stock is transferred. Discounts are applied. Dead stock is cleared.

Result

Cash returns. Shelf space opens.

Uncontrolled purchasing

With Odoo approvals and demand based reordering, impulse buying stops.

Result

Purchases align with sales. Cash pressure reduces.

Common Mistakes During Cash Recovery

- Trying to fix everything at once

- Cutting staff before cutting waste

- Chasing growth before fixing leaks

- Ignoring data and trusting gut

- Delaying hard decisions

Recovery requires clarity, not comfort.

When Odoo Needs Fast Customization

Some businesses need quick tweaks.

For example:

- Complex pricing structures

- Multi warehouse setups

- Manufacturing workflows

- Retail integrations

Odoo can be adjusted fast when needed, particularly during recovery-focused Odoo implementations designed for speed and control, not long-term perfection.

This is where experienced partners like EntrivisTech configure systems for recovery, not perfection.

Speed matters more than beauty in a turnaround.

Is Odoo Right for Your Turnaround Situation

Odoo is a strong fit if:

- You have delayed payments

- You have blocked inventory

- You lack visibility

- You need control quickly

Odoo may not help if:

- The business has no demand

- The product has no market

- Leadership refuses discipline

Software cannot fix a broken model. It can fix a broken system.

Frequently Asked Questions

Can Odoo really improve cashflow in ninety days

Yes, when used with focus on receivables, inventory, and control.

Is Odoo too heavy for small businesses

No. Odoo is modular and can be deployed fast for specific needs.

Does Odoo help with collections

Yes. It automates invoicing, reminders, and tracking.

Can Odoo reduce inventory

Yes. Through visibility, reordering rules, and demand alignment.

Is Odoo suitable for manufacturing and retail

Yes. These are two of the strongest use cases for Odoo in recovery situations.

Final Takeaway

Cashflow problems do not fix themselves. They also do not fix with motivation.

They fix with:

- Speed

- Control

- Discipline

- Visibility

Odoo gives all four.

Not in theory. In daily operations.

The businesses that recover are the ones that stop guessing and start controlling, often with guidance from teams experienced in operational turnarounds using Odoo, such as EntrivisTech.

In ninety days, the difference is visible.

TF 01, Raama Esquire, Laxmipura,

TF 01, Raama Esquire, Laxmipura,  hello@entrivistech.com

hello@entrivistech.com

+91 991 306 8606

+91 991 306 8606

Turnaround Playbook: Using Odoo to Stabilize Cashflow in 90 Days